- Investor Talk Daily

- Posts

- Deutsche Bank Faces Legal Setback Again

Deutsche Bank Faces Legal Setback Again

Trump's Tariff Strategy Could Drive Up Interest Rates and Ex-Abercrombie CEO Faces Trafficking Charges

Good morning, investor friends! It's the middle of the week, and let's make today a great one. Remember, don’t spend all day in the markets—take time to be with your family and fit in a workout! We have a lot to discuss today, so let’s dive in!

FINANCE

Deutsche Bank Faces Legal Setback Again

A German court has ruled against Deutsche Bank in a lawsuit concerning its acquisition of Postbank, marking a significant setback for the bank. The Cologne higher regional court decided in favor of 13 plaintiffs, former shareholders of Postbank, who alleged that Deutsche Bank underpaid for the retail bank during its multi-stage acquisition process. The plaintiffs argued that the bank’s 2010 offer of €25 ($27) per share undervalued Postbank, asserting they were entitled to €57.25 per share, the price Deutsche Bank paid for its initial 30% stake just before the Lehman Brothers collapse.

The ramifications of this ruling have overshadowed Deutsche Bank’s financial prospects. The bank recently reported a loss of €143 million in the second quarter due to a €1.3 billion provision related to the ongoing legal proceedings surrounding the Postbank acquisition. However, Deutsche Bank also managed to release €440 million in litigation provisions in the third quarter, resulting in a better-than-expected net profit of €1.46 billion ($1.58 billion) attributable to shareholders. While the bank has reached settlements with nearly 60% of the plaintiffs, its shares fell 2.3% following the court's judgment as it evaluates whether to appeal the ruling.

Source

ELECTION

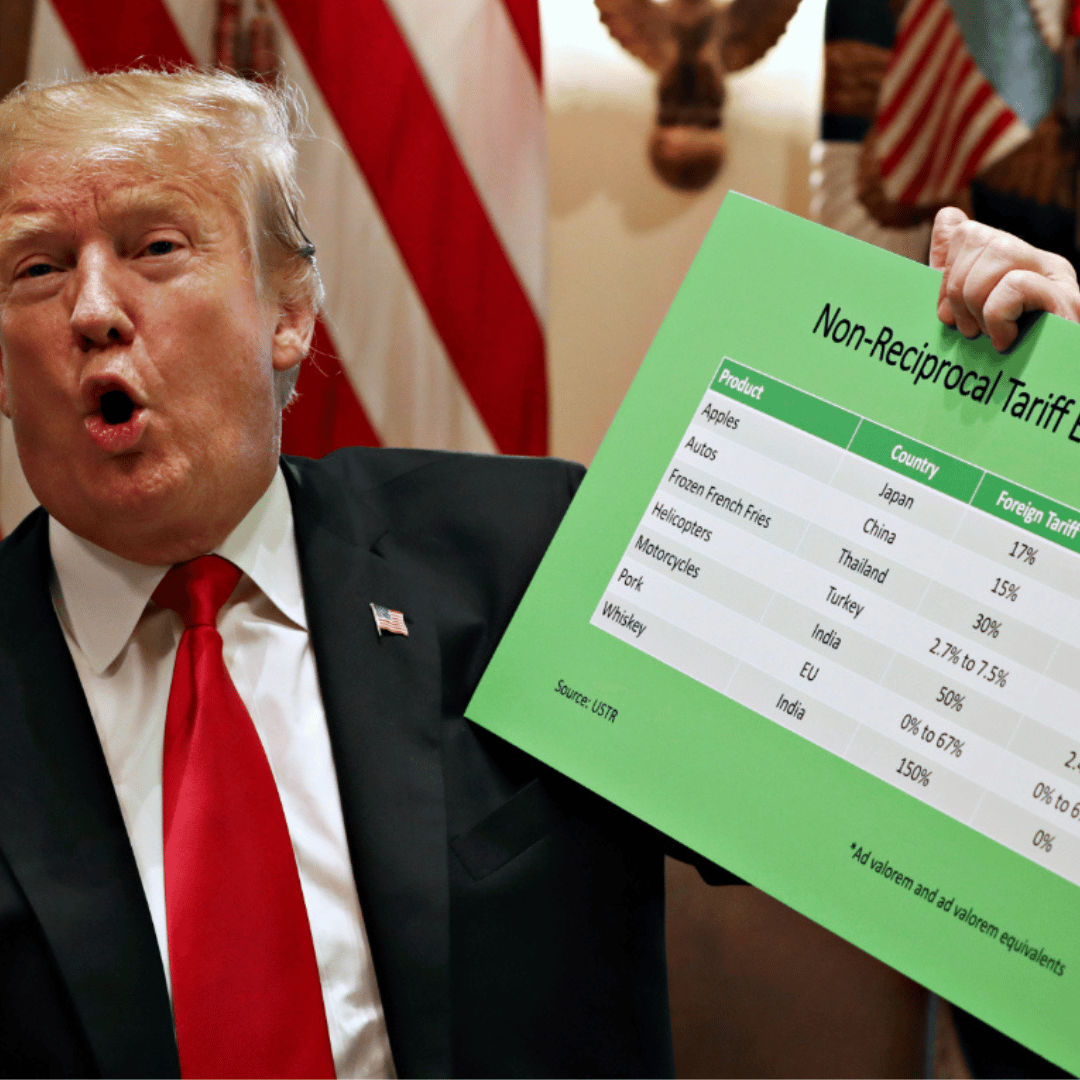

Trump's Tariff Strategy Could Drive Up Interest Rates

U.S. presidential candidate Donald Trump’s proposal for extreme tariffs risks disrupting disinflation trends and may lead to higher interest rates, according to Tim Adams, head of the Institute of International Finance (IIF). Trump's economic platform includes a universal 20% tariff on goods from all countries, a 60% tariff on Chinese imports, and a potential 100% tariff on cars from Mexico.

Adams stated that these tariffs could exert upward pressure on inflation and interest rates, hindering progress in reducing prices. Trump argues that higher tariffs incentivize companies to build factories in the U.S. to avoid costs, but analysts warn that his plans could create long-term inflationary pressures, especially with his broader agenda, including immigration curbs.

U.S. inflation was reported at 2.4% in September, down from a peak of 9% in mid-2022. As Trump campaigns for a return to the presidency, concerns about his protectionist approach contrast sharply with the international engagement expected from his opponent, Kamala Harris, underscoring the significant economic implications of the upcoming election.

Source

NEWS

Ex-Abercrombie CEO Faces Trafficking Charges

Mike Jeffries, the former CEO of Abercrombie & Fitch, faces serious accusations of sex trafficking. He, along with his partner Matthew Smith and an employee, allegedly operated an international sex trafficking ring between 2008 and 2015. Reports claim they coerced men into sex under the guise of offering modeling opportunities with the brand.

Jeffries, who led Abercrombie from 1992 to 2014, had a tenure filled with scandals, including a controversial, hyper-sexualized marketing strategy. Under his leadership, the company promoted exclusivity, staffed stores with young, shirtless men, and used risqué advertisements. Despite Jeffries’s success in transforming the retailer in the 1990s, his leadership style and disregard for cultural shifts led to declining sales and his eventual ousting in 2014.

Source

CRYPTO

Trump’s Crypto Venture Reveals Payout

Donald Trump’s crypto project, World Liberty Financial (WLF), is set to allocate 75% of its net revenue to a Trump-affiliated entity, DT Marks DEFI LLC, according to a newly released document. The remaining 25% of revenue will go to Axiom Management Group, run by project co-founders Chase Herro and Zachary Folkman. This setup means the Trump family stands to benefit significantly from WLF’s operations, with no liability or management role.

The project launched its “$WLFI” token, valuing it at 1.5 cents per token. The Trump family received 22.5 billion tokens, worth $337.5 million at launch. Despite Trump branding the project as “The DeFiant Ones,” WLF insists the tokens are not politically affiliated.

WLF aims to function as a crypto bank, allowing customers to borrow, lend, and invest in digital assets. Trump’s role as “chief crypto advocate” and his three sons as “Web3 ambassadors” positions the family prominently in the project. The document’s revenue split highlights Trump’s substantial financial stake while distancing the family from direct operational involvement.

Source

Word of the day

Pensive

See that person staring out the window who looks so sad and lost in thought? He is pensive, the opposite of cheery and carefree.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.