- Investor Talk Daily

- Posts

- Fortune 500 Layoffs Surge in Germany

Fortune 500 Layoffs Surge in Germany

Ikea Profits Plunge Amid Tariff Fears and Sanctions Expose Cracks in War Economy

FINANCE

Fortune 500 Layoffs Surge in Germany

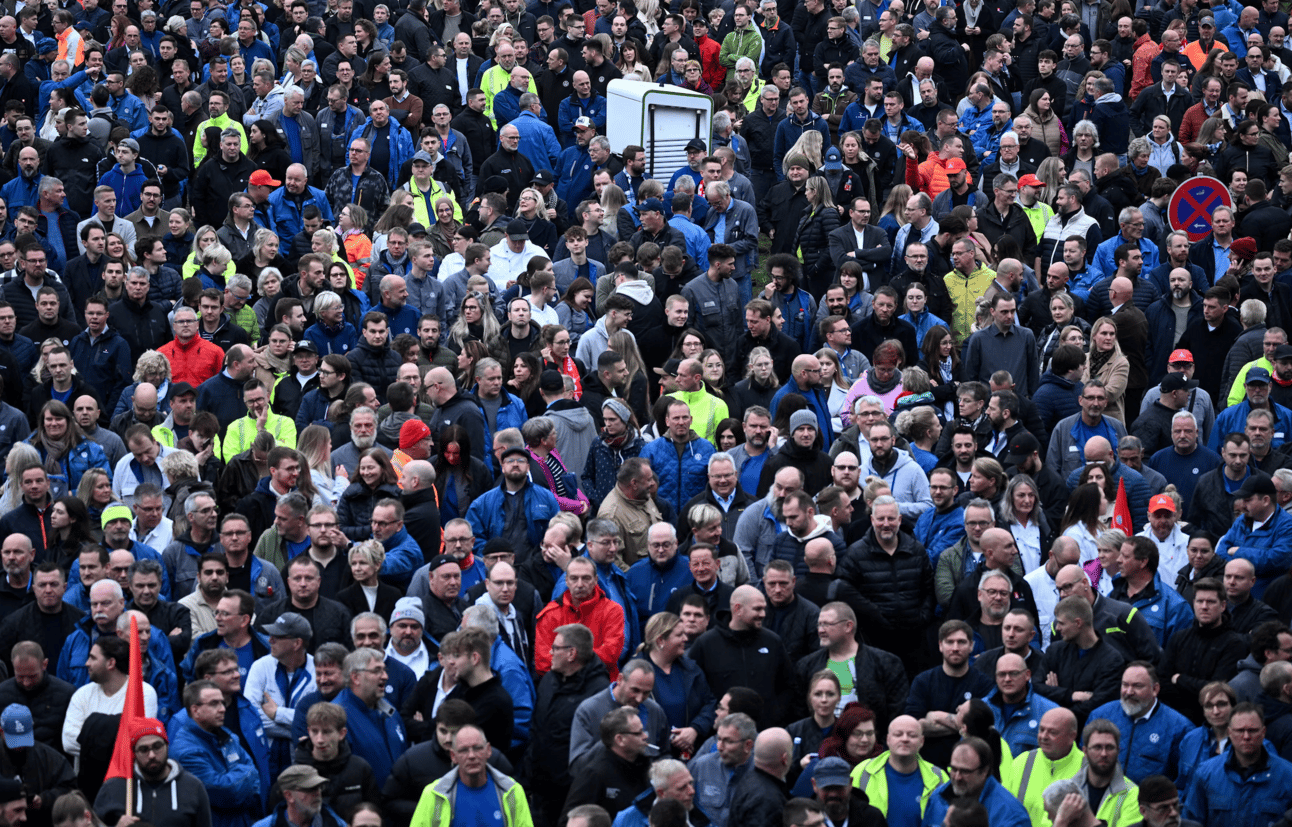

German Fortune 500 companies have announced over 60,000 layoffs in 2024, reflecting the nation’s ongoing economic struggles. Manufacturers like Bosch, Thyssenkrupp, and Siemens have been particularly impacted by rising energy costs and declining global demand, exacerbating challenges in Germany’s export-dependent economy. The country is bracing for its second consecutive year of negative economic growth, with its manufacturing sector in recession since 2022.

Bosch announced plans to cut 7,000 jobs, while Thyssenkrupp will lay off 11,000 steelworkers, citing competition from cheap Chinese imports. Siemens is also reducing its workforce by 5,000 as profits shrink. Meanwhile, Deutsche Bank has laid off 3,500 employees this year, with more reductions in senior management positions underway.

Volkswagen, Germany’s largest company, may soon follow, aiming to cut €10 billion in costs, potentially eliminating 15,000 jobs. The automaker has already canceled a long-standing labor agreement and plans its first factory closure. Analysts warn that the worst layoffs are yet to come.

Germany’s reliance on manufacturing, accounting for a larger GDP share than other European countries, makes the economic downturn particularly severe. With a shift in global manufacturing dynamics and persistent inflation, the backbone of Europe’s largest economy faces significant uncertainty and upheaval.

FINANCE

Ikea Profits Plunge Amid Tariff Fears

Ikea’s profits plunged nearly 50% this year as the retailer absorbed rising costs instead of raising prices, cutting prices by €2 billion to attract customers. While this approach boosted loyalty and sales, it strained Ikea’s finances, with parent company Ingka Group reporting a 47% drop in net profits to €800 million and a 5% revenue decline.

The outlook worsens with Donald Trump’s reelection and his proposed tariffs, including a 10% levy on Chinese imports. Ingka Group CEO Jesper Brodin warned that tariffs threaten Ikea’s ability to maintain affordable prices, which are central to its mission. Ikea sources 70% of its products from Europe and the rest from Asia, making global trade policies critical to its operations.

Despite its focus on affordability, tariffs could force Ikea to hike prices or relocate production. Brodin admitted such costs might eventually “end up on the bills of customers,” challenging Ikea’s low-price commitment.

RUSSIA

Sanctions Expose Cracks in War Economy

Russia’s war economy, resilient through two years of conflict and sanctions, is beginning to crack under new pressure. The ruble plunged to a 32-month low, trading at about 108 rubles to the dollar, before Russia’s central bank intervened by halting foreign currency purchases to stabilize markets.

The turning point came with U.S. sanctions on Gazprombank, the last major unsanctioned Russian bank, and over 50 other financial institutions. Gazprombank, crucial for trade payments and soldier salaries, had been exempted to facilitate energy transactions with Europe. Now targeted, the sanctions disrupt Russia’s access to hard currency, creating trade bottlenecks and inflationary pressures.

While President Putin reassured Russians that “there are no grounds for panic,” the economic impact is evident. Military spending, at record highs, has kept households afloat but strains the economy further. With the Biden administration’s sanctions tightening and global trade routes narrowing, Russia faces an uncertain economic future.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.