- Investor Talk Daily

- Posts

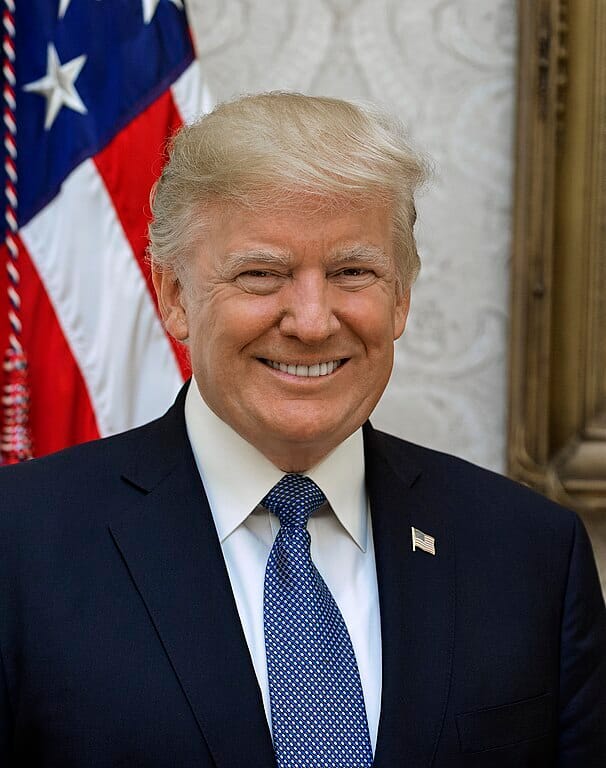

- Trump Warns BRICS Over Dollar Threat

Trump Warns BRICS Over Dollar Threat

Affordable Homes Vanish, Prices Surge and Nvidia: $1K to Nearly $1M

FINANCE

Trump Warns BRICS Over Dollar Threat

President-elect Donald Trump has threatened 100% tariffs on BRICS nations—Brazil, Russia, India, China, South Africa—and additional members like Egypt and the UAE, if they pursue de-dollarization efforts. In a Truth Social post, Trump demanded these countries abandon plans for a BRICS currency or risk losing access to the U.S. market. His comments underscore concerns over the alliance's push to reduce reliance on the dollar in global trade.

The dollar, currently representing 58% of global foreign exchange reserves, remains the dominant currency in international trade. However, the BRICS bloc, with its growing economic influence, seeks to challenge this dominance by conducting trade in non-dollar currencies. Russian President Vladimir Putin recently criticized the U.S. for “weaponizing” the dollar, advocating for alternative payment systems.

Despite these developments, research suggests the dollar’s role as the world’s primary reserve currency remains secure in the near term. Trump’s tariffs signal his determination to protect the dollar’s dominance while escalating tensions in global economic policy.

FINANCE

Affordable Homes Vanish, Prices Surge

Starter homes are shrinking while prices continue to rise, confirming the impact of "shrinkflation" in the housing market. According to research by Apollo, the median size of newly built single-family homes has dropped to 2,150 square feet, a 12% decrease from the 2016 peak of 2,500 square feet. Meanwhile, prices have skyrocketed—up 1.5 times since 2016. The average cost of a new single-family home in the U.S. rose from $288,400 in 2016 to $437,300 today.

The main culprits are rising construction costs and lingering pandemic-related challenges. Builders like BVM Contracting report material costs increasing by 20%-25% post-COVID, particularly for commodities like lumber. To mitigate costs, approximately 25% of new homes have been downsized, focusing on compact, functional designs. Open floor plans are being used strategically to create an illusion of spaciousness, appealing to buyers seeking affordability. Yet, the $300,000 starter home is becoming a relic of the past.

NVIDIA

Nvidia: $1K to Nearly $1M

If you invested $1,000 in Nvidia stock 20 years ago, you’d be on the brink of millionaire status today. According to Bespoke Investment Group, that investment would now be worth approximately $944,000, showcasing Nvidia as the best-performing stock on a total-return basis in the S&P 1500 over the past two decades.

Nvidia’s transformation from a graphics chip supplier for gaming to a key player in AI technology has been pivotal. The AI boom propelled Nvidia to replace Intel on the Dow Jones Industrial Average, cementing its status as a leader in generative AI. CEO Jensen Huang, now worth $118 billion, has been instrumental in this evolution.

Nvidia isn’t alone in delivering massive returns. Netflix, Apple, Amazon, and others have also turned modest investments into life-changing wealth. A $1,000 investment in Netflix 20 years ago, for example, would now be worth over $550,000, proving the power of patience in investing.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.